Want to peek inside the mind of the world’s best money-maker? I’m breaking down Warren Buffett’s must-read book list – straight from the man himself. No fancy investment talk. No get-rich-quick promises. Just the life-changing books that shaped how Buffett picks winning companies and turned $100 into billions.

These aren’t your typical Wall Street favorites. They’re the eye-opening reads that transformed a kid selling Coca-Cola door-to-door into someone who now owns part of the company. From Benjamin Graham’s timeless wisdom to Phil Fisher’s growth strategies, we’re diving into the exact books that guided Buffett from his humble Nebraska roots to becoming a living legend.

Let’s crack open his library.

Why This List Matters

Six hours daily. That’s how much Buffett spends reading, even today at 94. While others chase hot stocks and crypto trends, he fills his mind with business wisdom and annual reports.

These books aren’t just theory – they’re the foundation behind his 60+ years of market-beating returns. The same pages that gave him the confidence to invest $1.3 billion in Coca-Cola when everyone thought he was crazy, and the wisdom to skip the entire tech bubble of the 90s.

Ready to read like a billionaire?

Quick Overview

| Title | Category | Difficulty | Pages |

|---|---|---|---|

| The Intelligent Investor by Benjamin Graham | Non-Fiction/Investing | Moderate | 640 |

| Security Analysis by Benjamin Graham and David Dodd | Non-Fiction/Investing | Advanced | 720 |

| Common Stocks and Uncommon Profits by Philip Fisher | Non-Fiction/Investing | Moderate | 320 |

| Stress Test: Reflections on Financial Crises by Timothy Geithner | Non-Fiction/Economics | Moderate | 592 |

| The Essays of Warren Buffett by Warren Buffett | Non-Fiction/Business | Easy | 320 |

| The Outsiders by William Thorndike, Jr. | Non-Fiction/Business | Moderate | 272 |

| Business Adventures by John Brooks | Non-Fiction/Business | Moderate | 464 |

| First a Dream by Jim Clayton and Bill Retherford | Biography/Business | Easy | 400 |

| Poor Charlie’s Almanack edited by Peter Kaufman | Non-Fiction/Philosophy | Moderate | 548 |

| Where Are the Customers’ Yachts? | Funny/Finance | Easy | 208 |

Warren Buffett Book Recommendations

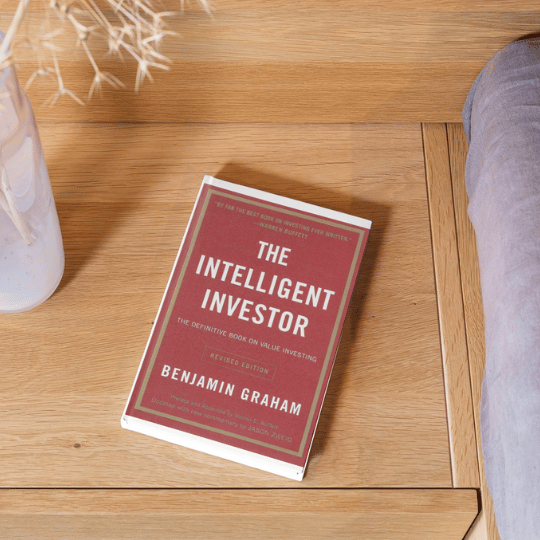

1. The Intelligent Investor by Benjamin Graham

Warren Buffett calls The Intelligent Investor “the best book on investing ever written,” and it’s easy to see why. First published in 1949, this classic is the foundation of value investing – a strategy that focuses on buying stocks priced below their intrinsic value.

Why does Buffett love it? Simple: it teaches investors to think long-term, avoid speculation, and always insist on a “margin of safety” – buying stocks at a discount to reduce risk. Graham’s famous concept of “Mr. Market” also helps investors stay rational during market swings by viewing price fluctuations as opportunities, not threats.

For anyone serious about investing, this book is a must-read.

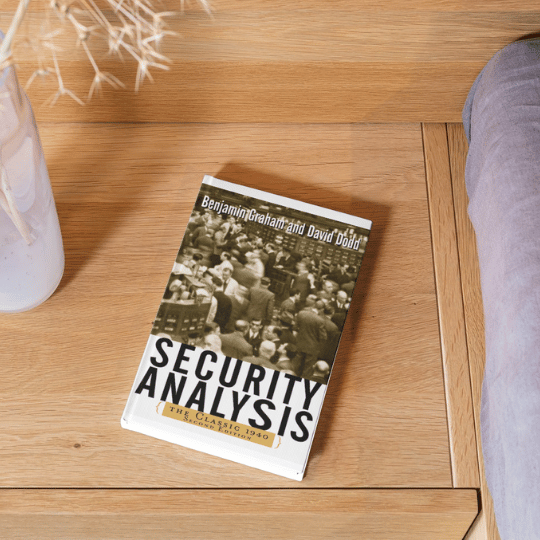

2. Security Analysis by Benjamin Graham and David Dodd

If The Intelligent Investor is the beginner’s guide to value investing, Security Analysis is the advanced playbook. Co-authored by Benjamin Graham and David Dodd in 1934, this book laid the groundwork for modern financial analysis and established the principles of value investing. It’s often referred to as the “bible” of investing.

Why does Buffett swear by it? This book teaches investors how to dig deep into a company’s financials, assess its intrinsic value, and make decisions based on hard data, not market noise. It emphasizes the importance of a “margin of safety,” which means buying stocks at a price far below their true worth to minimize risk.

For serious investors, Security Analysis is essential reading – it’s the toolkit that helps you separate speculation from sound investment.

3. Common Stocks and Uncommon Profits by Philip Fisher

Warren Buffett has often said that his investment style is a mix of Benjamin Graham’s value investing and Philip Fisher’s focus on quality. Common Stocks and Uncommon Profits is the book that introduced Buffett to Fisher’s approach, which emphasizes the importance of understanding a company’s qualitative aspects, not just its numbers.

Why does Buffett recommend it? Fisher teaches investors to look beyond the balance sheet and dig into a company’s management, growth potential, and competitive edge. He focuses on finding businesses with strong long-term prospects, rather than just undervalued stocks.

For Buffett, this book was key in shaping his strategy of investing in high-quality companies with durable competitive advantages – what he calls “wonderful companies at fair prices.”

4. Stress Test: Reflections on Financial Crises by Timothy Geithner

Warren Buffett recommends Stress Test because it offers a rare, insider’s perspective on one of the most critical financial events in modern history – the 2008 financial crisis. Written by Timothy Geithner, former U.S. Treasury Secretary, this memoir provides an in-depth look at the decisions and strategies that helped prevent a complete economic collapse.

Why does Buffett value this book? Geithner’s account highlights the importance of swift, decisive action during a crisis and the delicate balance between politics and policy-making. For investors like Buffett, understanding how financial systems respond to crises is key to navigating turbulent markets.

This book is a must-read for anyone looking to understand how global financial systems work under pressure and how leaders manage economic disasters.

5. The Essays of Warren Buffett: Lessons for Corporate America by Warren Buffett

If you’ve ever wanted to get inside Warren Buffett’s mind, The Essays of Warren Buffett is the closest you’ll get. This book is a collection of Buffett’s annual letters to Berkshire Hathaway shareholders, curated by Lawrence Cunningham. It distills decades of Buffett’s wisdom on investing, business management, and corporate governance.

Why does this book matter? It’s a treasure trove of practical advice straight from Buffett himself. He covers everything from the importance of long-term thinking, understanding intrinsic value, and sticking to your circle of competence, to how to assess risk and manage businesses effectively.

For investors, this book is a masterclass in disciplined investing and sound business principles – all in Buffett’s straightforward, no-nonsense style.

6. The Outsiders: Eight Unconventional CEOs and Their Radically Rational Blueprint for Success by William Thorndike, Jr.

Warren Buffett has called The Outsiders an “outstanding book about CEOs who excelled at capital allocation,” and it’s easy to see why. This book profiles eight unconventional CEOs who delivered extraordinary returns by thinking differently from their peers. These leaders, including figures like Tom Murphy of Capital Cities and Henry Singleton of Teledyne, didn’t follow the typical corporate playbook – instead, they focused on maximizing per-share value through strategic capital allocation.

Why does Buffett recommend it? The CEOs in The Outsiders prioritized smart investments, share buybacks, and operational efficiency over flashy acquisitions or rapid expansion. They understood that disciplined capital allocation is the key to long-term success.

For anyone interested in understanding how to run a business with a focus on shareholder value, this book is a must-read.

7. Business Adventures: Twelve Classic Tales from the World of Wall Street by John Brooks

Warren Buffett and Bill Gates both agree: Business Adventures is one of the best business books ever written. In fact, when Gates first met Buffett, this was the book Buffett recommended to him. Written by longtime New Yorker contributor John Brooks, this collection of 12 essays dives into some of the most fascinating stories in corporate history, from the rise of Xerox to the infamous Ford Edsel disaster.

Why does Buffett recommend it? Brooks’s storytelling brings to life the human side of business, showing how leadership decisions, market forces, and even luck can shape a company’s fate. It’s not just about numbers—it’s about understanding how businesses really work.

For anyone interested in timeless lessons on leadership, strategy, and the unpredictable nature of business, Business Adventures is a must-read.

8. First a Dream by Jim Clayton and Bill Retherford

First a Dream is the inspiring rags-to-riches story of Jim Clayton, founder of Clayton Homes, one of the largest manufacturers of mobile homes in the U.S. This memoir recounts Clayton’s journey from growing up on a small Tennessee farm during the Great Depression to building a multi-billion-dollar business empire.

Why does this book matter to Warren Buffett? It’s simple: Buffett admired Clayton’s business acumen so much that he eventually bought Clayton Homes in 2003 through Berkshire Hathaway. The book is filled with practical lessons on leadership, perseverance, and building a strong company culture – all values that resonate deeply with Buffett’s own approach to business.

For anyone looking for real-world insights into entrepreneurship and leadership, First a Dream is an essential read.

9. Where Are the Customers’ Yachts? by Fred Schwed Jr.

Where Are the Customers’ Yachts? by Fred Schwed Jr. offers a humorous yet scathing critique of Wall Street and the financial industry. Originally published in 1940, this book remains relevant today as it exposes the absurdities and contradictions within the world of finance. The title comes from an anecdote about a visitor in New York who, upon seeing the luxurious yachts owned by bankers and brokers, innocently asked where the customers’ yachts were—highlighting the disparity between the prosperity of financial advisors and their clients.

Why does this book matter to Warren Buffett? It provides timeless insights into human behavior and market dynamics, reminding investors to be skeptical of financial advice that prioritizes advisors’ profits over clients’ interests. Schwed’s witty narrative underscores the pitfalls of blindly following market trends and the importance of critical thinking in investing.

For those looking to understand the often ironic realities of Wall Street, this book is both an entertaining and enlightening read.

10. Poor Charlie’s Almanack edited by Peter Kaufman

Poor Charlie’s Almanack is a collection of speeches, essays, and life lessons from Charlie Munger, Warren Buffett’s longtime business partner and vice chairman of Berkshire Hathaway. Edited by Peter Kaufman, this book captures Munger’s unique approach to life, investing, and decision-making, all delivered with his trademark wit and wisdom.

Why does Buffett recommend it? Munger’s philosophy of worldly wisdom—the idea of using multiple mental models from various disciplines to solve problems—is a cornerstone of Berkshire Hathaway’s success. The book is packed with practical advice on thinking clearly, making better decisions, and understanding the importance of ethics in business.

For anyone looking to learn from one of the sharpest minds in investing, Poor Charlie’s Almanack is an essential read.