Introduction

Got an HDFC debit card snug in your wallet, but it’s more of a homebody than a high-flyer? Let’s change that! With a few simple steps, you can enable international usage and transform your card into a gateway for worldwide spending. Imagine snagging those concert tickets in London or that must-have gadget from New York, all with your HDFC bank card. By activating international transactions through net banking, your debit card for international escapades is just a click away. It’s easier than convincing a kid to eat candy, and I’m here to guide you through enabling your card for international adventures. So let’s activate international capabilities on your HDFC debit card and dress it for the international party—it’s time to unlock the world of borderless buying power!

Requirements for Enabling International Transactions on HDFC Debit Card

To enable international transactions on your HDFC Debit Card, ensure you have your Customer ID, Internet Banking credentials, and a registered mobile number with HDFC.

Step-by-Step Guide: How to Enable International Transactions on HDFC Debit Card

To activate international capabilities on your HDFC Bank debit card via the HDFC online banking system, adhere to the following instructions:

Ensure that you are enrolled in HDFC Bank’s online banking facility. If this service is yet to be activated for your account, you must register for it online.

Upon activation, proceed with these steps:

1. Log on to your HDFC online banking account by visiting: HDFC Bank Netbanking. Authenticate with your User ID and secure password to access your banking dashboard.

2. Inside the dashboard, proceed to the ‘Cards’ section. Within this area, focus on your debit card, not the credit card, then click on the ‘Request’ button.

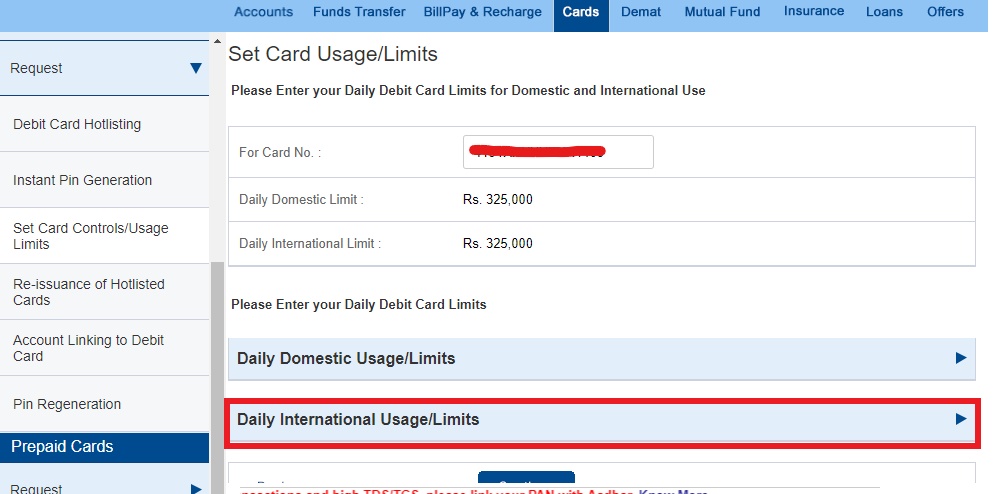

3. Under the ‘Request’ section, select the ‘Set Card Control/Usage Limit’ setting.

4. Pick out the debit card that you wish to prepare for international usage.

5. On the next page, there will be an option to activate the card for both ‘International and Domestic Use’. This needs to be selected unless it is already active, which would imply the card is set for international transactions.

6. The interface will show the preset limits for international transactions. Here, you can modify these to suit your needs. After adjustments, proceed by clicking ‘continue’.

7. To complete the process, provide your debit card’s ATM PIN and expiry date to validate and finalize the request.

This procedure will enable your HDFC debit card for international use, allowing transactions with international merchants and integration with payment platforms like PayPal.

For added security, it’s prudent to set an international transaction limit. This can be done through the ‘Request’ menu by selecting ‘Modify International Limit’, where you can stipulate your preferred transaction ceiling.

Note:

In order to assist you in managing your finances responsibly and avoiding overspending, we have created a comprehensive guide. If you’re looking for guidance on downloading your HDFC bank account statement, please refer to our article on the topic: How to Download HDFC Bank Account Statement. This resource aims to provide you with clear instructions and valuable insights to help you stay financially informed. Feel free to explore it at your convenience.

Are there any Additional Charges for Using my HDFC Bank Debit Card Internationally?

When using your HDFC Bank Debit Card internationally, be aware of potential charges. Expect a 3.5% currency conversion fee, additional fees set by Visa or Mastercard for exchange rates, and ₹125 + taxes for ATM withdrawals, with an extra 3.5% conversion fee. Plan accordingly to avoid unexpected expenses.

Conclusion

the process of enabling your HDFC Bank debit card for international transactions should now be clearer. We’ve covered the necessary steps to prepare your card for usage across borders, giving you the freedom to shop on global platforms and link to payment services such as PayPal. Should there be any queries or if any aspect of the procedure seems ambiguous, please don’t hesitate to reach out. Your feedback is valuable, and I invite you to share your thoughts or questions in the comments section. Let’s ensure that your banking experience with HDFC is seamless and secure for all your international and domestic needs.